How to Change Portugal NIF Address Online on Finance Portal

What is the requirement to change the Finance Address online?

- NIF Number

- Finance Portal Password (When will I receive my password?)

- A Valid Proof of Address

Do you need help with your Portugal Tax Returns? (Monthly or Trimester (Glovo, CAE 53200, Estafetas)

Our professional accountant provides tax filing services for foreigners living in Portugal.

Secure your spot for our 2024 Portugal tax returns filling service ->

Acceptable Proof of Address Documents

| Citizen | Residence | Acceptable Documents |

| EU / EEA Residence Card or EU / EEA Driver’s License or The first page of the bank statement issued within the past 3 months or Certificate of Permanent (5 Y) | Portugal | Portugal Residence Permit or Proof of Address (Junta) |

| EU / EEA citizens | Portugal | Certificate of Permanent (5 Y) |

| All Nationalities | EU / EEA citizens | EU / EEA Residence Card or EU / EEA Driver’s License or The first page of the bank statement issued within past 3 months or Certificate of Permanent (5 Y) |

Step 1: Log in to Portal das Finanças

- Go to https://www.portaldasfinancas.gov.pt/

- Click on the Iniciar Sessão button at the top right corner of the page.

3. Click on the NIF tab Option

4. Enter your NIF number. Where can I find my NIF number?

5. Enter your password.

6. Click the Authenticate button.

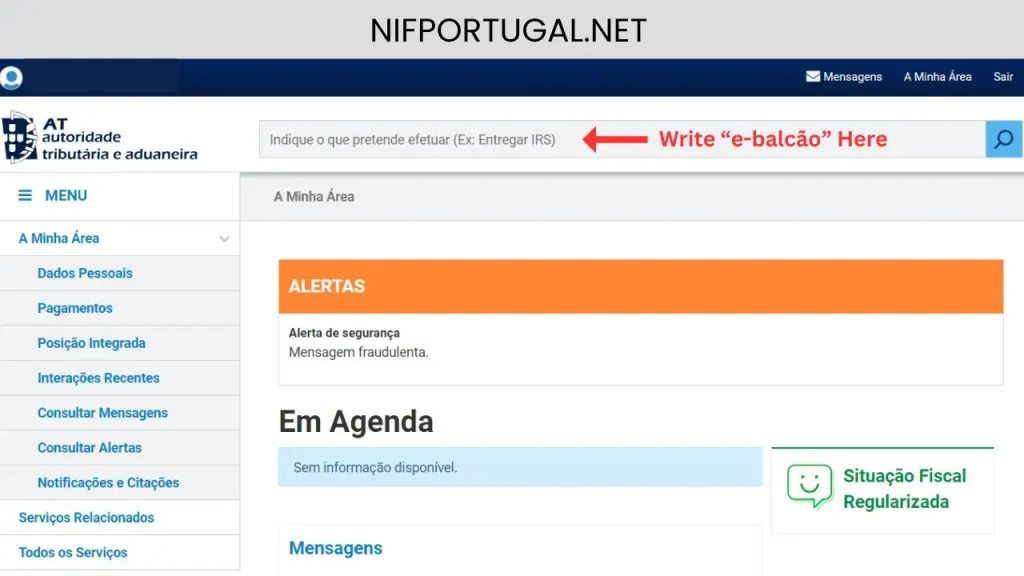

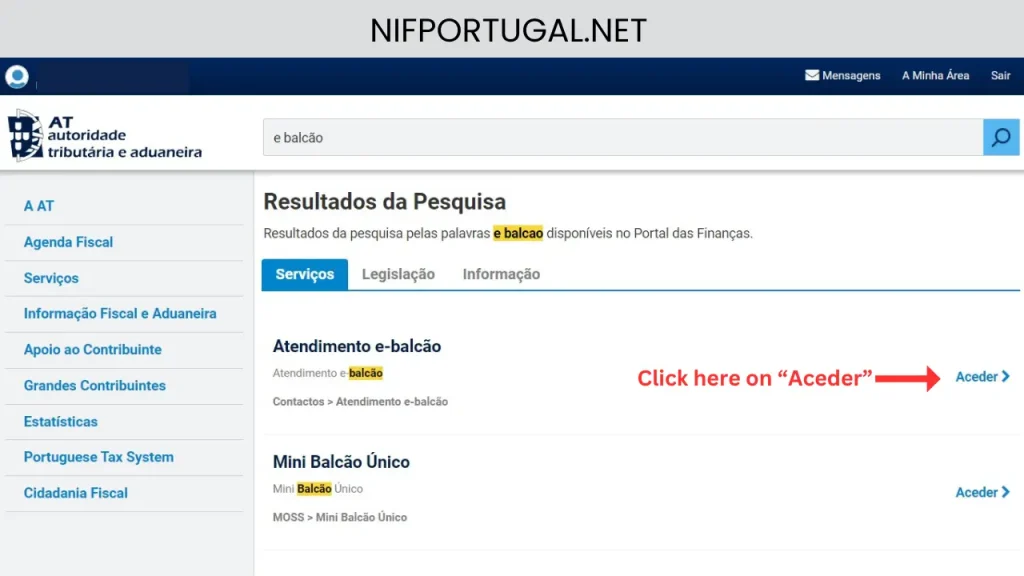

Step 2: Navigate to e-balcão

- Write the e-balcão on the top of the search bar.

2. Find “Atendimento e-balcão” and click Aceder.

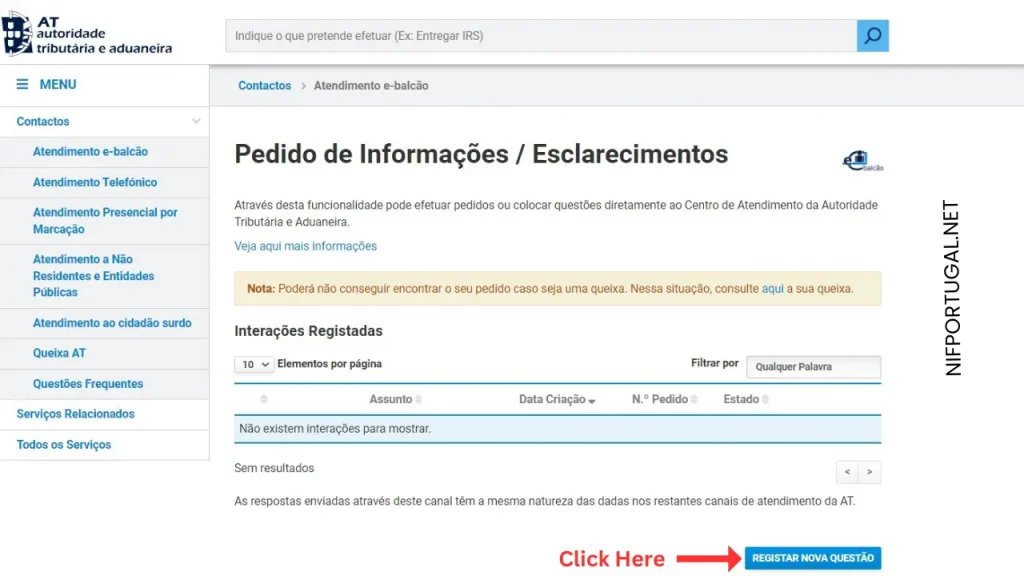

Step 3: Register a new question

Click on the “Register Nova Questão” button under the Pedido de Informações / Esclarecimentos section.

Step 4: Submit your request

Follow the given instructions below based on your country of residence.

4a. If you are a Portugal resident, follow these instructions.

4b. If you are an EU / EEA resident, follow these instructions.

Step 4a: Submit a request (Portugal Residents)

- Select the following options from the dropdown menus.

Dropdown Menu

Select

Imposto ou área

Registro Contribuinte

Tipo de Questão

Identific

Questão

Alteração Morada/Singulares

2. Select Não to the following question – “Alguma destas responde às suas dúvidas?”

3. Complete the form given on the finances Portal.

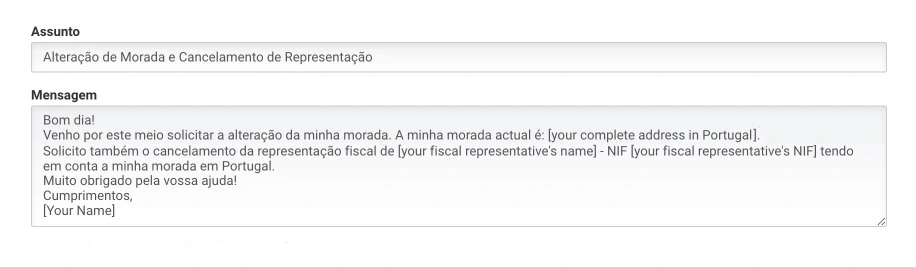

Copy-paste the text below and replace the following fields:

- [your complete address in Portugal]

- [your fiscal representative’s name]

- [your fiscal representative’s NIF]

| Form Field | Copy the Text | English Translation |

| Assunto | Alteração de Morada e Cancelamento de Representação | Change of Address and Cancellation of Tax Representation |

| Mensagem | Bom dia! Venho por este meio solicitar a alteração da minha morada. A minha morada actual é: [your complete address in Portugal]. Solicito também o cancelamento da representação fiscal de [your fiscal representative’s name] – NIF [your fiscal representative’s NIF] tendo em conta a minha morada em Portugal. Muito obrigado pela vossa ajuda! Cumprimentos, [Your name] | Good morning! I hereby request a change of my address. My current address is: [your complete address in Portugal including your parish]. I also request the cancellation of the tax representation by [your fiscal representative’s name] – NIF [your fiscal representative’s NIF] instead of my address in Portugal. Thank you very much for your help! Best, [Your name] |

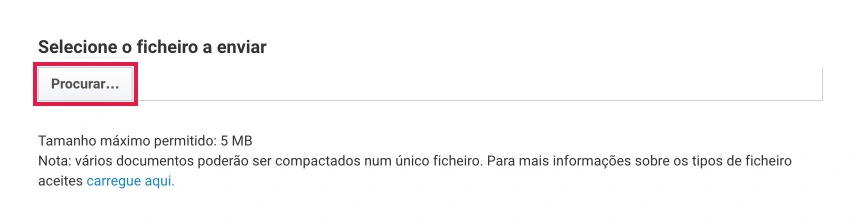

- Attach your proof of address.

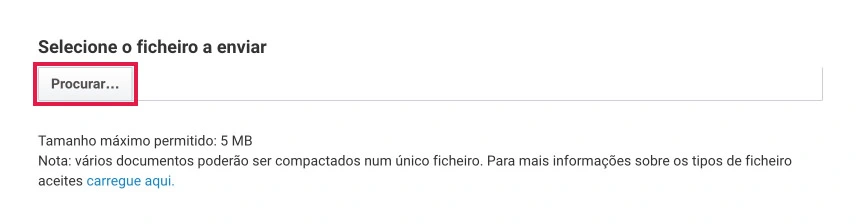

Under “Selecione o ficheiro a enviar”, click the Procurar button and upload your proof of address document.

- Click the Register Questão button to submit your request.

If you receive the following automated reply from Financas, it simply means that they have received your request and are processing it.

“A Autoridade Tributária e Aduaneira (AT) agradece o seu contacto. O pedido fica registado para análise e tratamento.

Com os melhores cumprimentos

AT- Autoridade Tributária e Aduaneira” - Wait for 1-2 business days before proceeding to the next step.

After 2 business days, you may follow up to check on the progress of your request. To do this, just click Reabrir on the bottom right side of the screen and send the following:

Step 4b: Submit Request (EU / EEA Residents)

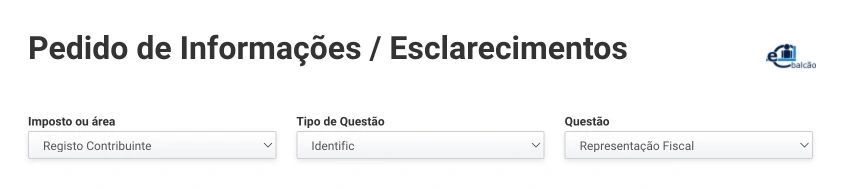

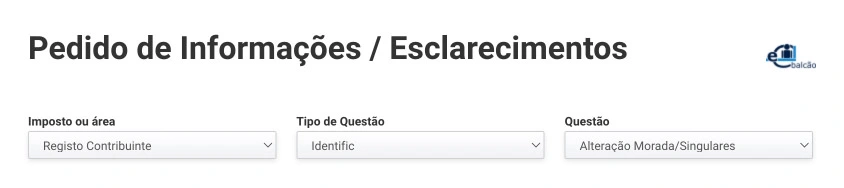

- Select the following options from the dropdown menus.

| Dropdown Menu | Select |

| Imposto ou área | Registro Contribuinte |

| Tipo de Questão | Identific |

| Questão | Representação Fiscal |

2. Select Não to the following question – “Alguma destas responde às suas dúvidas?”

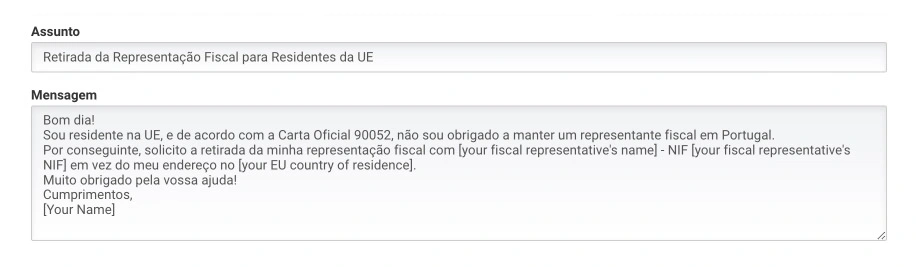

- Complete the form.

Copy-paste the text below and replace the following fields:

- [your fiscal representative’s name]

- [your fiscal representative’s NIF]

- (Name)

Your fiscal representative’s information name and NIF number will be listed on your NIF document. Where can I find my fiscal representative’s information?

| Form Field | Copy the Text | English Translation |

| Assunto | Retirada da Representação Fiscal para Residentes da UE / EEE | Withdrawal of Fiscal Representation for EU / EEA Resident |

| Mensagem | Bom dia! Sou residente na UE / EEE, e de acordo com a Carta Oficial 90052, não sou obrigado a manter um representante fiscal em Portugal. Por conseguinte, solicito a retirada da minha representação fiscal com [your fiscal representative’s name] – NIF [your fiscal representative’s NIF] tendo em conta a minha morada em [your country of residence]. Muito obrigado pela vossa ajuda! Cumprimentos, [Your Name] | Good morning! I’m an EU / EEA resident, and as per Official Letter 90052, I am not obligated to maintain a fiscal representative in Portugal. Therefore, I hereby request for the withdrawal of my fiscal representation with [your fiscal representative’s name] – NIF [your fiscal representative’s NIF] instead of my address in [your country of residence]. Thank you very much for your help! Best, [Your name] |

- Attach your proof of address.

Under “Selecione o ficheiro a enviar,” click the Procurar button and upload your proof of address document.

- Click the Register Questão button to submit your request.

If you receive the following automated reply from Financas, it simply means that they have received your request and are processing it.

“A Autoridade Tributária e Aduaneira (AT) agradece o seu contacto. O pedido fica registado para análise e tratamento.

Com os melhores cumprimentos

AT- Autoridade Tributária e Aduaneira” - Wait for 1-2 business days before proceeding to the next step.

After 2 business days, you may follow up to check on the progress of your request. To do this, just click Reabrir on the bottom right side of the screen and send the following:

| Copy This Text | English Translation |

| Acompanhamento do pedido de retirada da minha representação fiscal | Follow-up on my fiscal representation withdrawal request |

Step 5: Sign and upload the Alteração document (optional)

Note: the tax office sometimes skips this step, so if you do not receive an Alteração document, you can proceed to the next step.

- Log in to Portal das Finanças.

- Navigate to e-balcão (see Step 2).

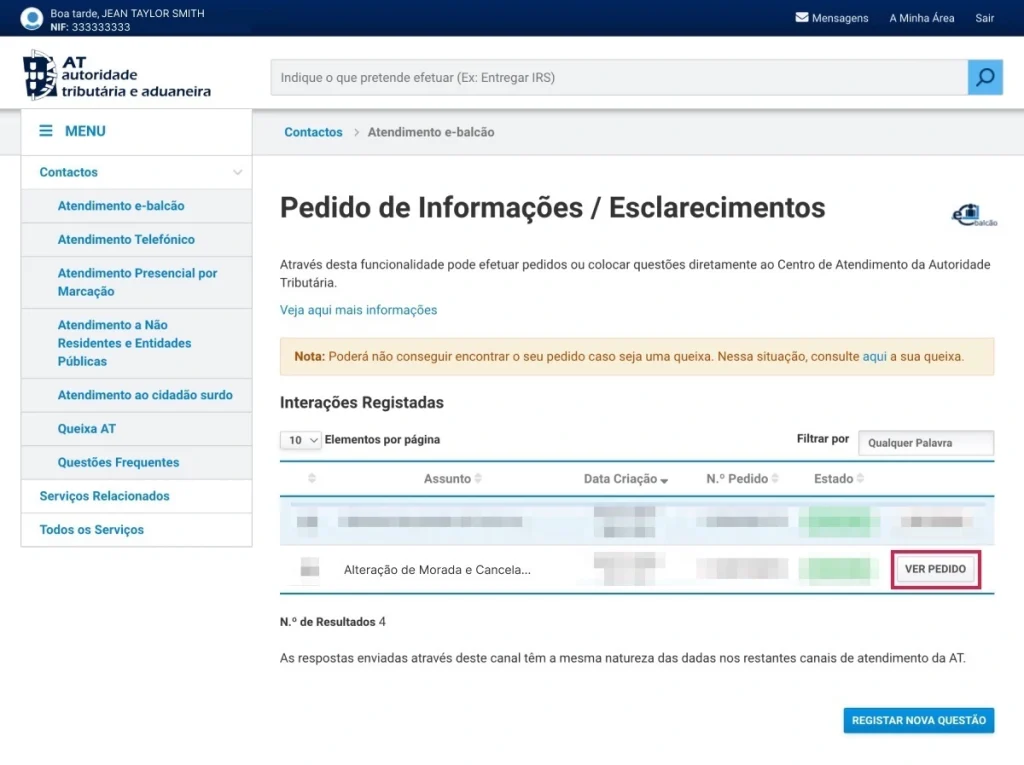

- Under Interações Registadas, click the Ver Pedido button to find your message thread.

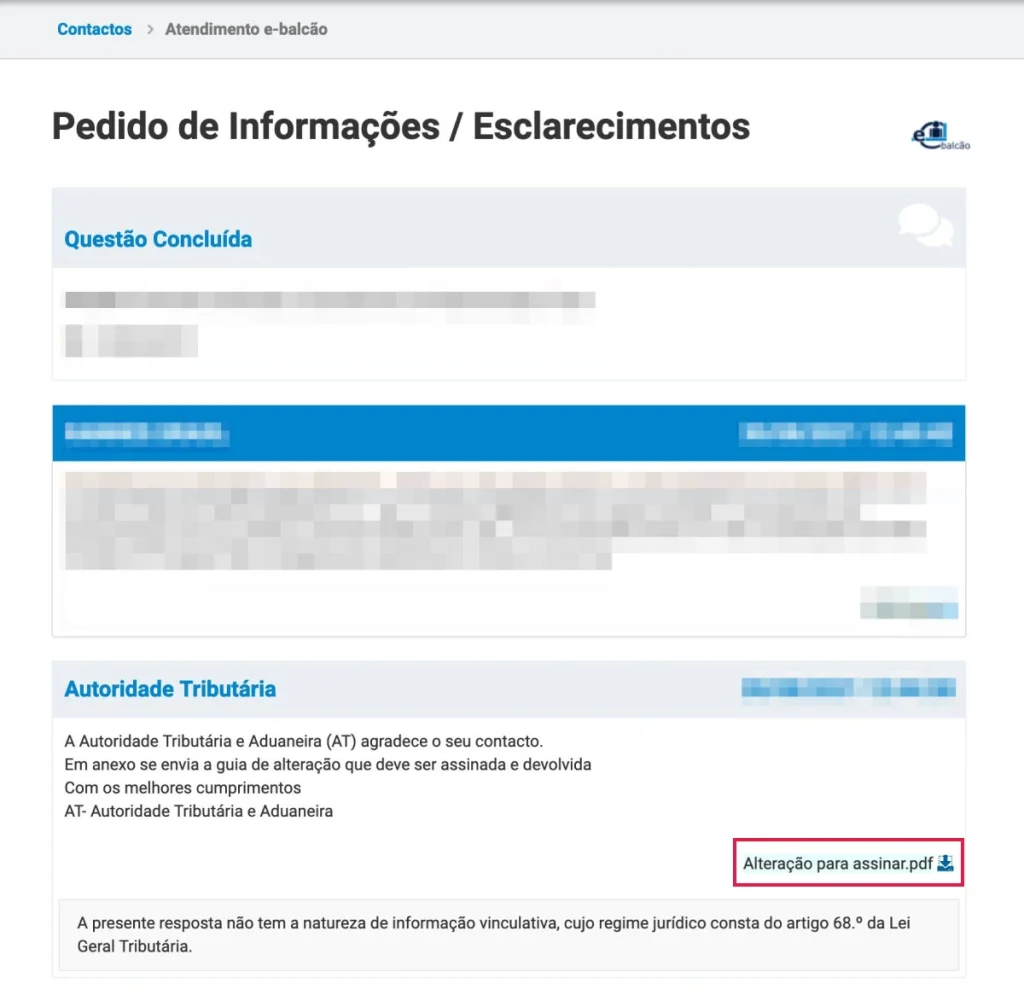

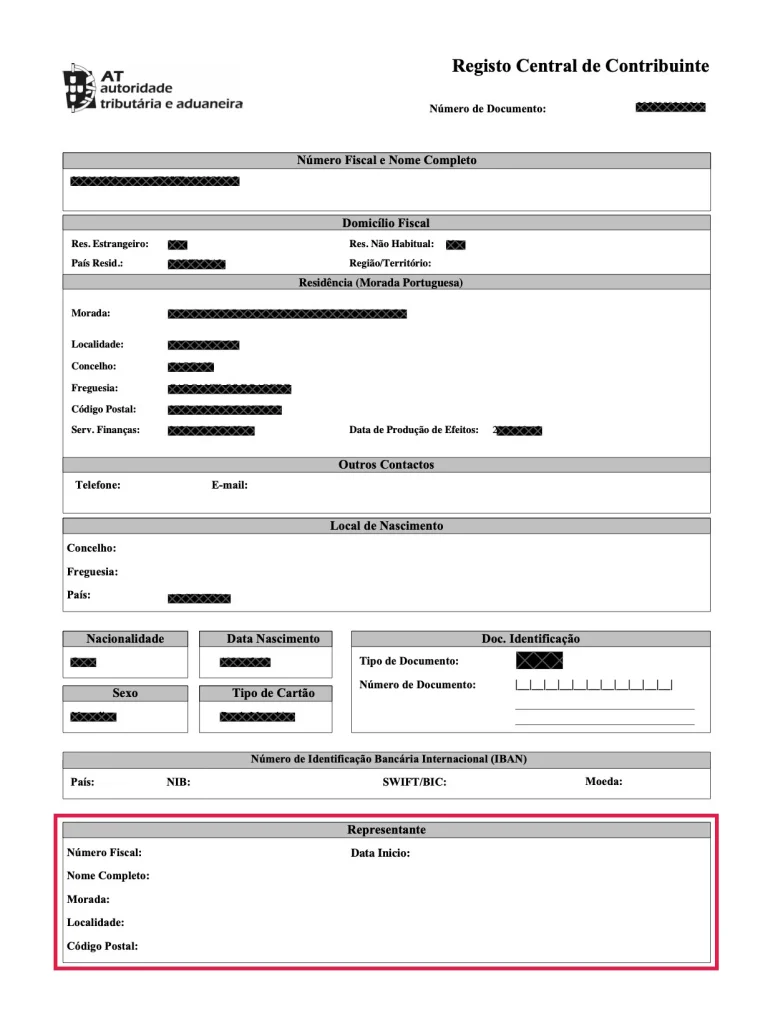

- You should see a message from Autoridade Tributária with a document for you to sign and return. It should have the word Alteração (“change”).

- Download the Alteração document and complete the following:

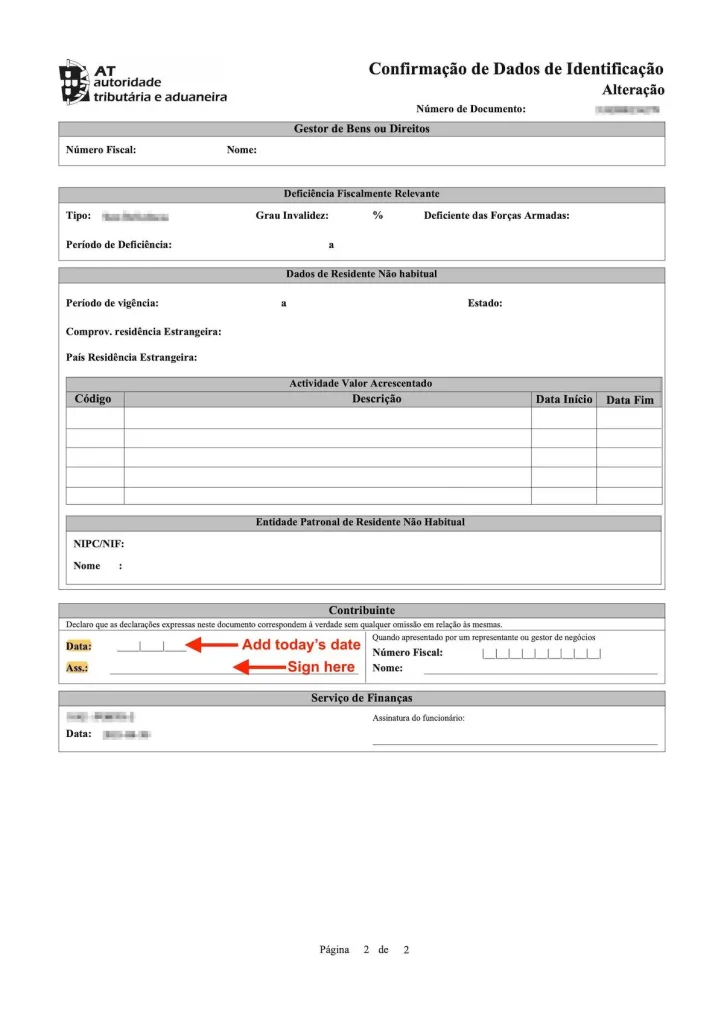

Page 1 – Verify that all information is accurate.

Page 2 – Add your signature and today’s date (see example below).

6. Attach your signed Alteração document and reply to the thread with the following message:

| Form Field | Copy This Text | English Translation |

| Message Body | Veja o documento assinado em anexo | See signed document attached |

7. Wait 1-2 business days before proceeding to the next step.

Step 6: Download your updated NIF

- Log in to Portal das Finanças.

- Navigate to e-balcão (see Step 2).

- Under Interações Registadas, click the Ver Pedido button to find your message thread.

- Download your updated NIF document! 🎉

The Representation section of your new NIF document should be empty.

If you’d like to cancel your fiscal representation with Bordr, email a copy of your updated NIF document to [email protected] or upload it on the app.