A Guide For Self-Employed Jobs & Taxes in Portugal 2025

Although Portugal’s economy may not provide the same chances or pay as other European nations, it has developed consistently in recent years. Portugal is renowned for having an excellent standard of living, stunning scenery, a vibrant cultural history, and a moderate climate. The nation draws many visitors because of its laid-back way of life and emphasis on work-life balance.

In general, Portugal appeals to those looking for a new place to call home because of its natural beauty, rich culture, safety, and high standard of living. Portugal has something to offer everyone. On the whole, nonetheless, living expenses are less than in many other Western European nations.

Concerning this, we have seen many people moving to Portugal to set up their businesses or even to work from home. It might be a surprise for many of you, but not anymore. Today, in this blog post, I have covered all the details and information one must know to be self-employed in Portugal. So, let’s get started with our guide right away!

How to Apply Portugal Job Seeker Visa

How to Become Self-Employed in Portugal?

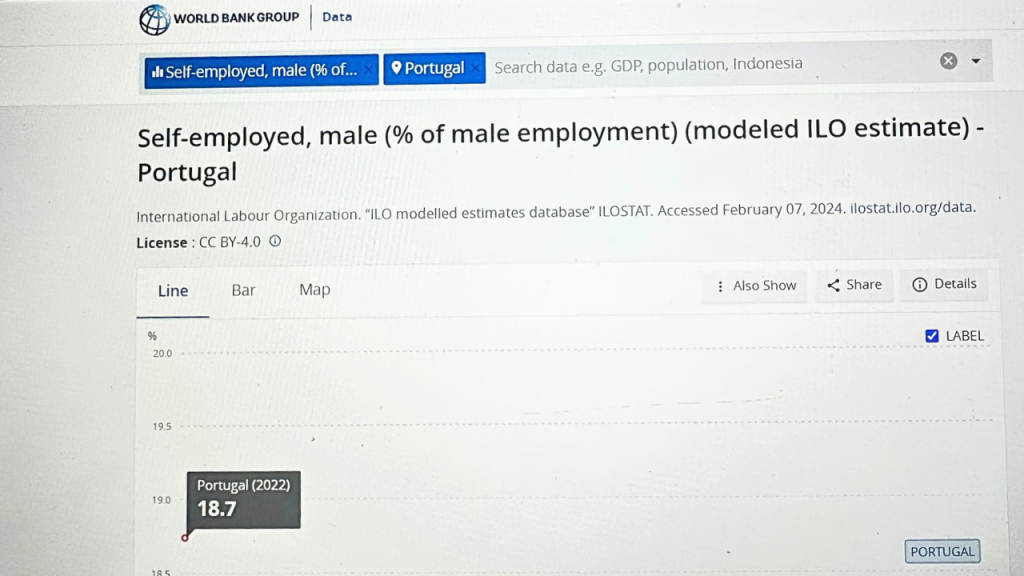

According to 2022 World Bank data, 30.5% of Portugal’s workforce comprises self-employed individuals, with 11.8% being women and 18.7% men. Those looking to become self-employed in Portugal can choose between two main paths: freelancing or establishing their own business. Below is a comprehensive guide detailing these options and the steps involved.

Starting Your Business

Starting your business is one way to be self-employed by living in Portugal. Self-employment in Portugal comes with its pros and cons. But simultaneously, you can move worldwide and have additional permanent residency perks.

Freelancing in Portugal

Portugal is a highly well-liked destination for remote workers who are independent contractors or self-employed, and it has lots of coworking options. So, if you work as a freelancer in Portugal, you have the same status as a visitor who stays in for an extended time if you operate remotely from Portugal as a digital nomad.

So, basically, in Portugal, you are regarded as a solo entrepreneur if you launch your own freelancing company. Therefore, the same conditions that apply to establishing a sole proprietorship also apply to offering your services within the country.

Who Can Work as a Freelancer in Portugal?

Anyone who wants to work freely in various industries and is a resident or non-resident of Portugal can pursue freelancing. This primarily indicates that whether you are from Portugal or not, you can be self-employed and get your visa procedure done; other than that, the detailed information on the categories of individuals in Portugal who can work as freelancers are as follows:

For EU Citizens

It is demonstrated in the guidelines issued annually by the Portuguese government that without a work visa, nationals of the European Union (EU) and countries that are part of the European Economic Area (EEA) are permitted to live and work in Portugal. In addition, they can readily enter the freelancing workforce and add to the vibrant professional scene in the country. This has been a significant development based on all the progress Portugal has made in its laws and economic guidelines.

For Non-EU Citizens

People not from EU and EEA can still work in Portugal as a freelancer. To work as a freelancer in Portugal, non-EU/EEA nationals must apply for a work visa. In addition to no surprise, Portugal offers several appealing visa choices for independent contractors, such as the Digital Nomad Visa, the D2 Visa Portugal, and more.

Types of Visas in Portugal: Complete Guide for Visa & TRC in 2025

Types of visas for self-employed to work in Portugal

Digital Nomad Visa Portugal

The finest of all is that the digital nomad visa has been released under the policy 2022, and you can freely live in Portugal to work as a self-employed and foreign freelancer. Moving on, you are given two options or pathways and can choose whatever suits you the best.

The first category is the temporary stay visa, for people who plan to be in Portugal for only a year. The other is the permanent residency visa. It is for the ones willing to live in the country for an extended period. Also, fortunately, people opting for residency visas can renew their visa after 5 years, so that’s a pretty good deal, I believe.

Portugal D2 Visa

It is specifically designed for entrepreneurs, as the name states, and for foreign freelancers who plan on investing in Portuguese businesses or want to try something from Portugal. For the visa application, you must complete your documents online and get your visa within a few weeks.

Golden Visa Portugal

The famous Portugal Golden Visa which is falls under the Portugal freelance visa category is another excellent option for non-EU freelancers hoping to live and work in Europe. If you have a Golden Visa, you can apply for a two-year temporary residency permit that can be renewed every two years. The Portugal Golden Visa program offers several opportunities, including funding scientific research, an investment fund, and investments in Portugal’s cultural and historic industries.

How to register as a freelancer in Portugal?

Before making any big decision, you must always think and look into the authentic information being provided by the officials. So, before deciding to move to Portugal, here is what you must know!

Get Your Work Permit

First and foremost, you must have a work permit from the Portuguese embassy as soon as possible because you can do nothing without that. Also, I don’t want to confuse you that the work permit is only required for non-EU and non-EEA citizens. So, for people who are from EU or EEA countries, you don’t need to have it.

Work Permit Portugal (D1 Visa) in 2025

Get your NIF Number

NIF is a Portugal taxation number, primarily income tax which is compulsory for people living in Portugal to have. In addition, it is a nine-digit number that you can get from the Portuguese tax authority yourself from the portal by applying online, or can also ask for help from any trustworthy organization. This should be your priority as with the help of NIF, you will be able to open your bank account and without that, you can not run a business, nor can you work as a freelancer.

How do You Register as a Freelancer in Portugal?

The guide to registering as a freelancer in Portugal is easy if you are already done with the abovementioned documentation. To move further, here is what you need to know!

How Can We Help You? – NIF Portugal

We at NIF Portugal work closely with the Portugal tax authority departments and clients to make it easy for them to get their NIF numbers as soon as possible. The faster you receive your nine-digit NIF number, the sooner you can begin working from Portugal as a freelancer or self-employed individual.

Most of our global clientele hire us to cut down on hassles, quicken business processes, and overcome language barriers and other issues. So, if you are one of them or having a hard time processing the documents in Portugal, book an appointment with us immediately because there is no way my readers get worried over such things. That said, I hope to see you on the other side. Cheers!